Maximizing Efficiency and Streamlining Approval Processes with a FileMaker Application: EDC’s Success Story

Government/Export Industry

FileMaker Implementation at EDC: A Solution for Process Optimization and Team Capacity Increase

Export Development Canada, Canada’s Export Credit Agency, is managing investment projects worth hundreds of millions of dollars to support Canada’s economic activity.

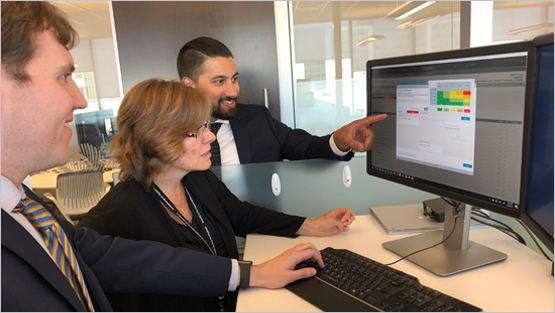

The Structured and Project Finance (SPF) group, responsible to underwrite EDC’s largest and most complex transactions is employing 40 resources located in Ottawa, Toronto and Singapore.

Creating a Comprehensive Risk Assessment and Documentation Platform in FileMaker for EDC

With a significant business growth of the Canadian export transactions, SPF was running above full capacity on a semi-consistent basis. Also, recent changes required business process adjustment increasing transaction touch time.

Approval process relied on many scattered documents and ad hoc processes. Management was looking to free up team’s capacity by an optimization of its end-to-end processes with a better regulation of the approval process for funding projects and a more efficiently/effectively processing of the loan transactions.

Having considered the available resources, critical timeline to business value and overall project risk, EDC decided to entrust Direct Impact Solutions with the mandate to implement an enterprise web solution with FileMaker as a technological base, even though it was not an organizational standard.

FileMaker Solution to Improve Efficiency at EDC’s SPF Group

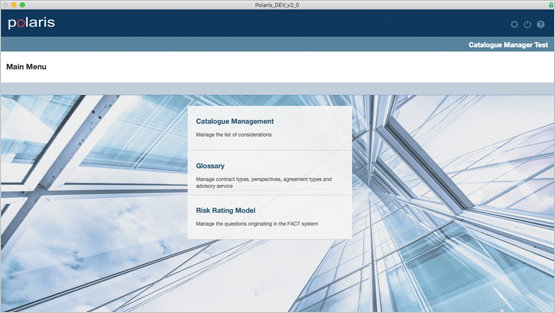

A brand-new software application was developed by Direct Impact Solutions in FileMaker and deployed in 6 months.

The app is guiding the risk assess and documentation process respectively for the specific characteristic of their sector, which is following a rigorous due diligence protocol.

Maximizing Benefits with FileMaker: Standardization, Data Consolidation, and Real-Time Collaboration at EDC

- Consolidating unstructured data access in single location/source.

- Recycling data throughout end to end process.

- Providing a standardized approach recognizing asset class specificities.

- Offering a real-time “Glass pipeline” and multi user collaboration.

- Ensuring process completeness with imbedded quality assurance controls.

- Providing real-time data exchange with EDC’s internal Risk Model system.

- Supporting analysis with contextual guidance instruction;.

- Offering automatic data feed from EDC’s official system of record.

- Allowing the highest residual risk identification and maintaining audit traceability.

- Generating email and PDF attachments.

- Secure server hosting

- Allowing platform configuration without additional software development.

- Allowing real-time configurable standardized catalogue (SPF Knowledge Base) in support of sector’s specific or generic underrating risk analysis.